Property Tax Rate For Maury County Tn . the maury county commission sets the property tax rate. Property tax information last updated: our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Tennessee law does not require the mailing of tax notices. You may begin by choosing a search. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home value of. To report fraud, waste & abuse:

from www.luxuryrealestatemaui.com

Tennessee law does not require the mailing of tax notices. You may begin by choosing a search. the maury county commission sets the property tax rate. To report fraud, waste & abuse: our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Property tax information last updated: the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home value of.

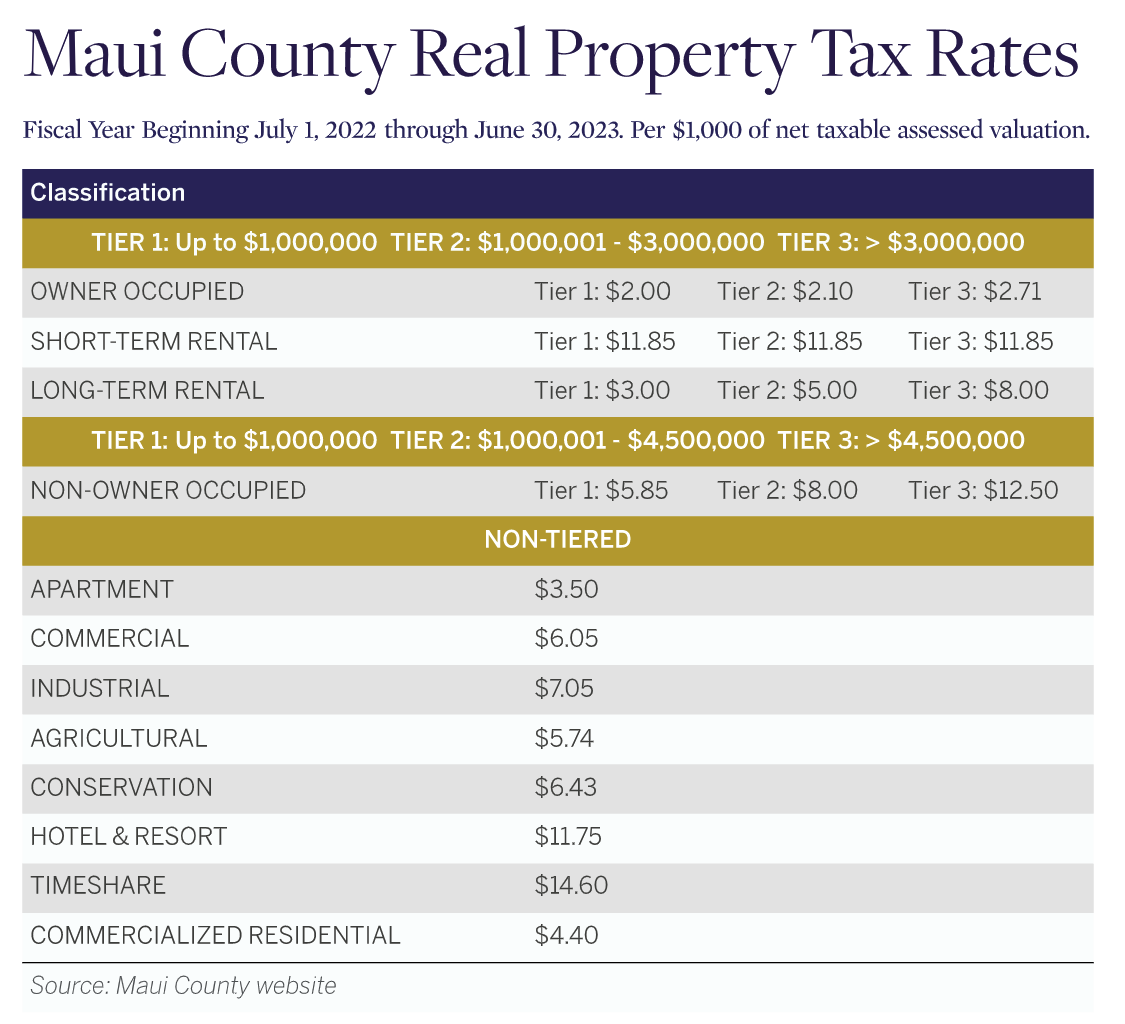

Maui Property Taxes Fiscal Year 2023 Tax Rates

Property Tax Rate For Maury County Tn our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Tennessee law does not require the mailing of tax notices. You may begin by choosing a search. To report fraud, waste & abuse: the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Property tax information last updated: the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home value of. the maury county commission sets the property tax rate.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate For Maury County Tn Tennessee law does not require the mailing of tax notices. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. Property tax information last updated: You may begin by choosing a search. the median property tax (also known as real estate tax). Property Tax Rate For Maury County Tn.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate For Maury County Tn You may begin by choosing a search. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. the maury county commission sets the property tax rate. our maury county property tax calculator can estimate your property taxes based on similar properties, and show. Property Tax Rate For Maury County Tn.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Property Tax Rate For Maury County Tn Tennessee law does not require the mailing of tax notices. You may begin by choosing a search. To report fraud, waste & abuse: the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. the maury county commission sets the property tax rate. Property tax. Property Tax Rate For Maury County Tn.

From dxowdwmaj.blob.core.windows.net

Average Property Tax Rate In Tennessee at Robert Chabot blog Property Tax Rate For Maury County Tn the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home value of. the maury county commission sets the property. Property Tax Rate For Maury County Tn.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rate For Maury County Tn the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. Property tax information last updated: To report fraud,. Property Tax Rate For Maury County Tn.

From exozpkwqw.blob.core.windows.net

Maury County Tn Vehicle Sales Tax at Glennis Fluharty blog Property Tax Rate For Maury County Tn the maury county commission sets the property tax rate. our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. You may begin by choosing a search. To report fraud, waste & abuse: Property tax information last updated: the median property tax (also known as real estate tax). Property Tax Rate For Maury County Tn.

From www.mapsofworld.com

Maury County Map, TN Map of Maury County Tennessee Property Tax Rate For Maury County Tn our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To report fraud, waste & abuse: the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Property tax information last updated: the maury. Property Tax Rate For Maury County Tn.

From exonpxgws.blob.core.windows.net

Property Tax Records Maury County Tennessee at Basil Wade blog Property Tax Rate For Maury County Tn Tennessee law does not require the mailing of tax notices. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Property tax information last updated: To report fraud, waste & abuse: the maury county commission settled on a county property tax rate of $1.91,. Property Tax Rate For Maury County Tn.

From exonpxgws.blob.core.windows.net

Property Tax Records Maury County Tennessee at Basil Wade blog Property Tax Rate For Maury County Tn Property tax information last updated: Tennessee law does not require the mailing of tax notices. our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called. Property Tax Rate For Maury County Tn.

From www.wrightforshelby.com

The county budget Commissioner Mick Wright Property Tax Rate For Maury County Tn the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Tennessee law does not require the mailing of tax notices. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting. Property Tax Rate For Maury County Tn.

From dxogyttcy.blob.core.windows.net

Property Taxes In Beverly Ma at Anthony Livingston blog Property Tax Rate For Maury County Tn the maury county commission sets the property tax rate. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home. Property Tax Rate For Maury County Tn.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate For Maury County Tn Property tax information last updated: the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To report fraud, waste & abuse: the maury. Property Tax Rate For Maury County Tn.

From exonpxgws.blob.core.windows.net

Property Tax Records Maury County Tennessee at Basil Wade blog Property Tax Rate For Maury County Tn the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Property tax information last updated: You may begin by choosing a search. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home. Property Tax Rate For Maury County Tn.

From www.mof.gov.sg

MOF Press Releases Property Tax Rate For Maury County Tn our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. Property tax information last updated: To report fraud, waste & abuse: the median. Property Tax Rate For Maury County Tn.

From www.wkrn.com

Increased property values mean different things for property taxes Property Tax Rate For Maury County Tn the maury county commission sets the property tax rate. You may begin by choosing a search. the maury county commission settled on a county property tax rate of $1.91, or an increase of 31 cents at a special called meeting on thursday. our maury county property tax calculator can estimate your property taxes based on similar properties,. Property Tax Rate For Maury County Tn.

From www.topmauihomes.com

Property Taxes Property Tax Rate For Maury County Tn our maury county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. You may begin by choosing a search. To report fraud, waste & abuse: Property. Property Tax Rate For Maury County Tn.

From giodgkohq.blob.core.windows.net

Maury County Tn Tax Records at Rochelle Moore blog Property Tax Rate For Maury County Tn You may begin by choosing a search. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home value of. our maury. Property Tax Rate For Maury County Tn.

From hxebhbnbm.blob.core.windows.net

White County Tn Property Tax Records at Eduardo Jackson blog Property Tax Rate For Maury County Tn the median property tax (also known as real estate tax) in maury county is $924.00 per year, based on a median home value of. You may begin by choosing a search. the assessor maintains property ownership records and maps, and provides tax rolls for the county trustee and municipal collectors for tax billing and collections. the maury. Property Tax Rate For Maury County Tn.